Everyone is selling everything today in the stock. Nothing is spared: Stocks, Precious Metals, Currencies, Etc. The Dow is Down over 400. It looks really bad for everything. What is Going On?

For years, through both Democrat and Republican administrations, we have inflated our economy like a bubble with artificial low interest rates. Yesterday, Bernanke announced a global “rob Peter to pay Paul” technique he called Operation Twist. It’s a National version of Pay off one Credit Card with Another Credit Card with a Lower Interest Rate. Rather than admit that we as a nation have built our economy on consuming, rather than producing, the Federal Reserve chose to try to inflate the economy yet again. It’s not working. If you examine history, it really lasts for more than a few years. Let’s look at how this crisis parallels the Great Depression.

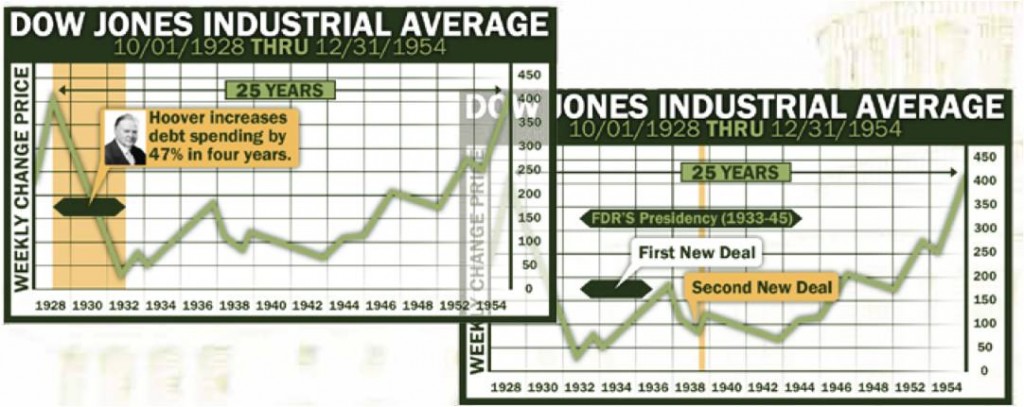

President Hoover (A Republican President) followed the insane logic of doing the same thing over and over again expecting a miraculous different result. He tried to “overspend” and inflate a hurting economy. The problem? The miracle never came. As the pressure of his spending grew each year, he foolishly repeated the unsuccessful deficit spending of the year before. Hoover did not demonstrate the restraint of a Godonomics free market capitalist. He was not a fiscal conservative. Hoover’s financial blood-letting was killing the economy.

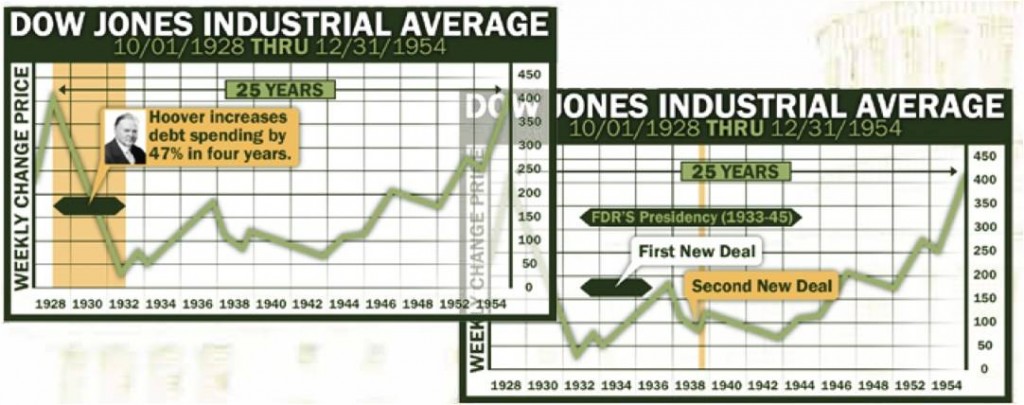

Welcome Franklin D. Roosevelt to the presidential stage. He, too, was an insane thinker. Observing Hoover’s overspending and all the economic damage it had done to the nation, he concluded, “That worked so well for Hoover, I’ll do the same—on steroids.” He launched the First New Deal borrowing and spending incredulous amounts of money to begin humongous government programs. His shot of adrenalin produced a modest climb to the Dow Jones. Unfortunately, it was merely “a sugar high.” There was an initial boost that didn’t get the Dow Jones nearly as high as it was before, but it produced a temporary change of direction.

F.D.R. decided to practice some more insane thinking. He thought to himself, “This is working so well, let’s do a Second New Deal.” He forgot that the problem with sugar highs is the let-down. The problem with getting drunk on credit-spending is tomorrow’s hangover.

To help us grasp this concept, let’s bring the national economic sugar high from the First New Deal down to an individual level. We can be in financial trouble and decide to charge a lot of stuff on a new credit card giving us a temporary sugar high. We can keep buying stuff on credit without a job or a way to pay for it giving us the drunkard’s temporary relief from life’s problems. It will work briefly for a while, but ultimately, what goes up must come down. Because the adrenalin shot did not produce new blood, it was not a viable plan for long-term economic recovery. Worse yet, like the drunkard’s alcohol, it really compounds his problems until finally something has to give. F.D.R.’s second shot of adrenalin was the proverbial straw that broke the camel’s back, and the Second New Deal finally broke the system.

God says, “We cannot spend tomorrow’s money today and be prosperous in the long run.” We will reap what we sow. This is an economic law. It’s absolute truth. We can delay this law’s impact for the short term, but we’ll never outrun it. It’s a law to discover, not a principle to outrun. Think of it like other laws of the universe.

We don’t defy the law of gravity, we discover it. We can put on a parachute or strap on a hang glider to soften gravity’s impact, but we cannot change reality.

The Dow Jones chart sums reality up well. The economic laws of the consequences of overspending caught up to F.D.R. America had a depression within our depression. If you look at history books today and compare and contrast U.S. history with other nations, we had the Great Depression while the world had a depression. The Dow Jones fell 50% as the Second New Deal picked up speed because of the excessive spending desperately trying to break the economic law that spending tomorrow’s money today cannot heal a nation terminally ill with diabetes.

Not only did the ailing Dow Jones fall, it stayed at almost record lows for over twenty-five years. The higher F.D.R.’s deficit-spending went, the higher unemployment stayed. The more far-reaching into the future purses of her citizens F.D.R.’s policies dipped, the more her economy was punished. The honest diagnosis? The more the government spent, the more it consumed from the real production of the private sector.

One might question what got us out of the Great Depression, if it wasn’t the New Deals? Some tell us that it was World War II that brought us out of the Depression. Before swallowing that hook-line-and-sinker, let’s remember that a war requires more deficit spending because the increased demand for supplies is coming from government consumption. Wars don’t fix economies; they consume from economies. If wars were truly economic solutions, someone might suggest that declaring war is a means to a nation’s job recovery.

The truth about the United States’ recovery can be found as Americabegan producing again! The Great Depression cut the fat on many of the mal-investments and new sectors of productive activity began to sprout. Non-productive industry was eliminated and productive industries were born. The renewed productivity of American ingenuity was so strong, it was even able to overcome the consumption of World War II. Although the war consumed some of that new production, the spirit and resourcefulness of Americans overcame the many economic disasters left byHoover and F.D.R. The recovery was amazing when government finally untie the hands of the private sector to produce.

Do the facts support these claims? Can we prove that the overspending did more harm than good? A picture is worth a thousand words. We can see the-proof-in-the-pudding on the Dow Jones chart alone, but there is a plethora of research supporting these facts. Amity Shlaes book The Forgotten Man has hundreds of pages documenting this reality. She spells out exactly what happened. Fact after fact, she proves that borrowing and deficit spending when we have a crisis is fool- hardy. Many other books such as New Deal, Raw Deal by Burton W., Jr. Folsom documents these facts as well. An outstanding organization substantiating these facts is The Cato Institute (www.cato.org.)

So what should we do? The Bible says we live in a broken world: a world that is not operating according to God’s original blueprint. Natural disasters, other’s foolishness, and my own covetousness are just the beginnings of the problems operating in our present reality. Because this world is filled with evil, the Bible teaches us to diversify our savings.

Ecclesiastes 11:2 “Give a serving to seven, and also to eight, for you do not know what evil will be on the earth.”

The writer advises us to diversify our savings and investments into seven or eight places. The reason for diversifying is that we do not “know what evil will be on the earth.”

The Bible also reminds us that He is in control. Money, Markets, and Economic Systems that seem secure are mere clay in the Great Potter’s Hands. He is the one who raises kings and kingdoms and takes them down. The book of Daniel shows that God sees the future and the past. If you are fearful or scared, remember that He is the anchor in a storm. He is the one sure thing. He is the unchangeable one in uncertain times. He is the same “yesterday, today, and forever.” Cling to Him. Cry Out to Him. Hold on to Him. Daniel lived through several economy mountains and valleys. He even witnessed a supernatual moment when the hand of God came down and wrote on the wall, “I’ve weighed your wisdom, your kingdom, and you have been found wanting.” This great Babylonian kingdom that seemed so secure was dismantled that very night by the Persians. God always resists the proud and draws near the humble. Let us follow the example of Daniel and stay humble before our God and trust Him to handle the global affairs.

For more information, check out www.godonomic.com